Retirement benefit is a cash benefit either in monthly pension or lump sum paid to a member who can no longer work due to old age.

Qualifications

- A member who is 60 years old, separated form employment or ceased to be self-employed, and has paid at least 120 monthly contributions prior to the semester of retirement.

- A member who is 65 years old whether employed or not and has paid at least 120 monthly contributions prior to the semester of retirement.

- Has reached the age of 55 years old and is an underground mine worker for at least 5 years (either continuous or accumulated) prior to the semester of retirement but whose actual date of retirement is not earlier than March 13, 1998; separated from employment or in the case of self-employed, has ceased self-employment, and has paid at least 120 monthly contributions prior to the semester of retirement.

- Has reached the age of 60 years old whether employed or not.

Types of Retirement Benefits

Monthly Pension

The monthly pension is a lifetime cash benefit paid to a retiree who has paid at least 120 monthly contributions to the SSS prior to the semester of retirement.

Lump Sum

The lump sum amount is granted to a retiree who has not paid the required 120 monthly contributions. It is equal to the total contributions paid by the member and by the employer including interest.

In this post, I will be discussing the monthly pension calculation only.

In this post, I will be discussing the monthly pension calculation only.

Monthly Pension

Benefit Computation

The monthly pension depends on the member's paid contributions, his credited years of service (CYS), and the number of his dependent minor children that must not exceed five. The monthly pension will be the highest amount resulting from either one of these three pension formulae:- the sum of P300 plus 20 percent of the average monthly salary credit plus two percent of the average monthly salary credit for each credited year of service (CYS) in excess of ten years; or

- forty (40) percent of the average monthly salary credit; or

- P1,200, if the CYS is at least 10 but less than 20; or P2,400, if the CYS is 20 or more.

A member who retires after age 60 with a total of 120 monthly contributions may be qualified to a monthly pension based on whichever is higher of the following:

- the monthly pension computed at the earliest time the member could have retired had been separated from employment or ceased to be self-employed plus all adjustments thereto; or

- the monthly pension computed at the time when the member actually retires.

- the monthly pension computed for the first retirement claim; or

- the re-computed monthly pension for the new claim

Illustration

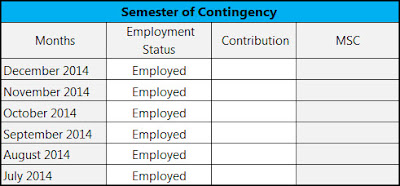

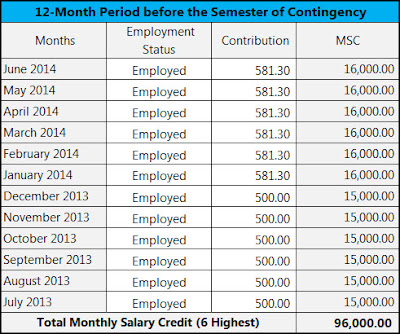

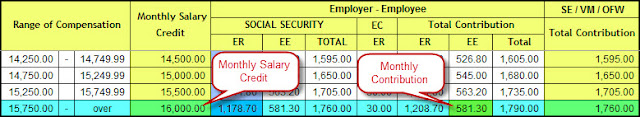

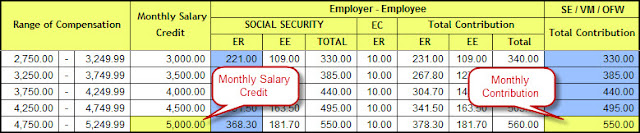

An employed SSS member with monthly salary of P 30,000.00 and is now 60 years old is eligible to retire after working for 30 years.Referring to SSS table of contribution, the retiree's contribution is P 581.30 and P 1,208.70 for his employer's contribution. Total contribution of P 1,790.00 per month. This total amount is his average monthly contribution. Thus, his average monthly salary credit (AMSC) falls to P 16,000.00.

Average total contribution is P 1,790.00 x 30 years x 12 months = P 644,400.00.

Method 1

Monthly SSS Pension = (AMSC) 20% + (AMSC) 2% for year of service in excess of 10 years + PHP300

Monthly SSS Pension = (P 16,000*20%) + (P 16,000*2%*20 years) + P 300

Monthly SSS Pension = P 3,200 + P 6,400 + P 300

Monthly SSS Pension = P 9,900.00

Method 2

Monthly SSS Pension = (P 16,000*20%) + (P 16,000*2%*20 years) + P 300

Monthly SSS Pension = P 3,200 + P 6,400 + P 300

Monthly SSS Pension = P 9,900.00

Method 2

Forty percent (40%) of the average monthly salary credit

Monthly SSS Pension = P 16,000 * 40%

Monthly SSS Pension = P 6,400.00

Method 3

Monthly SSS Pension = P 16,000 * 40%

Monthly SSS Pension = P 6,400.00

Method 3

P 1,200, provided that the credited years of service (CYS) is at least 10 or more but less than 20 or P 2,400, if the credited years of service CYS is 20 or more.

Monthly SSS Pension = P 2,400.00 since he has more than 20 credited years of service.

The highest amount among the three methods of computation will be the retiree's monthly pension. Thus, the first computation yields as the highest with P 9,900.00. His monthly pension can be based on this amount.

For him to break-even in his contributions, it will take for at least 5.40 years (65.1 months) to fully benefit from the pension assuming he has not used any of his SSS benefits.

Monthly SSS Pension = P 2,400.00 since he has more than 20 credited years of service.

The highest amount among the three methods of computation will be the retiree's monthly pension. Thus, the first computation yields as the highest with P 9,900.00. His monthly pension can be based on this amount.

For him to break-even in his contributions, it will take for at least 5.40 years (65.1 months) to fully benefit from the pension assuming he has not used any of his SSS benefits.

Check out also our online SSS Pension calculator here.

%2B(1).png)

51 comments :